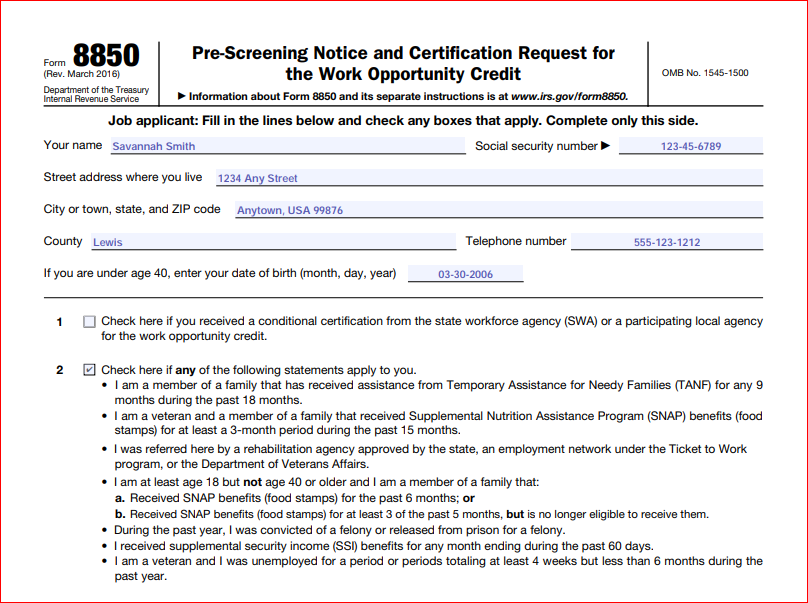

| As advertised in their Business Services card, Debra introduced the Work Opportunity Tax Credit to Erika. Debra first explained the intent of the program (tax incentive to employers for hiring target applicants) and explained the tax benefit: Erika's business could recoup 40% of Savannah's wage in a dollar-for-dollar tax credit if Savannah worked 400 hours in her first year of employment. Given Savannah's work schedule, she will exceed 400 hours. As promised in the brochure, Debra volunteered to complete the initial verification form (8850) and help submit it within 28 days of Savannah's hire date. Debra provided a copy of the (8850) and referred Erika to the IRS website for more information on the tax credit. (See attached 8850 below.)

|